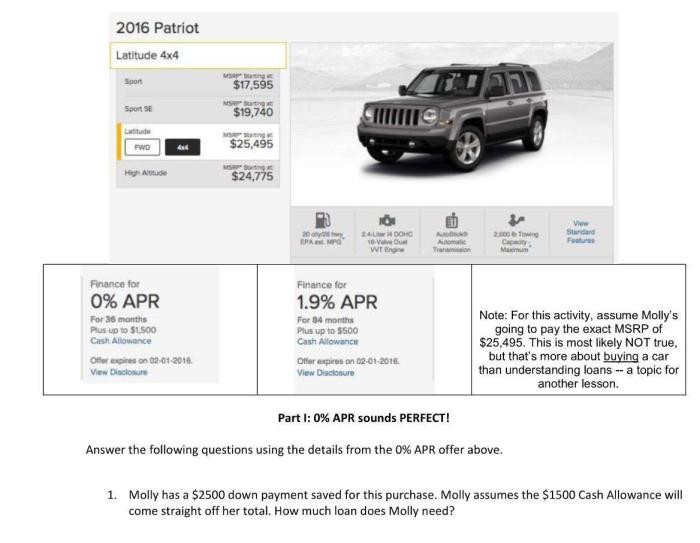

Remember that molly has a 2500 down payment – Remember that Molly has a $2,500 down payment? This significant financial milestone marks the beginning of an exciting journey toward homeownership. Join us as we delve into the intricacies of real estate transactions, mortgage options, financial planning, and the responsibilities associated with homeownership.

With expert insights and practical guidance, we will empower Molly and other aspiring homeowners to make informed decisions and achieve their dream of owning a home.

Understanding the significance of a down payment is crucial for any homebuyer. It not only demonstrates financial stability but also impacts mortgage eligibility and loan terms. Molly’s $2,500 down payment provides a solid foundation for securing financing and obtaining favorable mortgage rates.

Down Payment: Remember That Molly Has A 2500 Down Payment

A down payment is a substantial sum of money paid upfront when purchasing a property. It represents a portion of the property’s purchase price and is typically required by lenders to secure a mortgage. The size of the down payment can significantly impact the terms and eligibility for a mortgage loan.

With a down payment of $2,500, Molly may face challenges in obtaining a mortgage. Many lenders require a down payment of at least 20% of the property’s value to avoid private mortgage insurance (PMI), which is an additional monthly expense.

With a $2,500 down payment, Molly may need to consider government-backed loans, such as FHA or VA loans, which have lower down payment requirements.

Down Payment Assistance Programs

- Down Payment Assistance (DPA) programs are designed to help first-time homebuyers with limited financial resources to make a down payment. These programs provide grants or low-interest loans that can be used towards a down payment.

- Local and state governments, as well as non-profit organizations, often offer DPA programs. Eligibility criteria and program terms may vary depending on the program and location.

Mortgage Options

Based on her down payment amount, Molly may qualify for various types of mortgages, each with its own interest rates, loan terms, and monthly payments.

Conventional Loans

- Conventional loans are offered by private lenders and are not backed by the government.

- Typically require a down payment of at least 20% to avoid PMI.

- Offer competitive interest rates and loan terms.

FHA Loans

- FHA loans are insured by the Federal Housing Administration (FHA).

- Allow for down payments as low as 3.5%.

- Typically have higher interest rates and mortgage insurance premiums than conventional loans.

VA Loans

- VA loans are backed by the Department of Veterans Affairs (VA).

- Available to eligible veterans, active-duty military personnel, and their families.

- Offer no down payment requirement and competitive interest rates.

Financial Planning

Purchasing a home requires careful financial planning to ensure Molly can afford the mortgage payments and other associated costs. Creating a detailed budget is essential.

Budgeting

- Molly should create a comprehensive budget that includes all her income and expenses.

- She should allocate a portion of her income towards her mortgage payment, property taxes, insurance, maintenance, and other housing-related expenses.

- Tracking expenses and adjusting the budget as needed will help Molly stay on track financially.

Saving and Increasing Income, Remember that molly has a 2500 down payment

- Molly should explore ways to increase her savings, such as reducing unnecessary expenses or finding additional income sources.

- She can consider a part-time job, starting a side hustle, or negotiating a raise at her current job.

Emergency Fund

- Building an emergency fund is crucial for unexpected expenses that may arise, such as job loss or medical bills.

- Molly should aim to save at least three to six months’ worth of living expenses in an easily accessible account.

Homeownership Responsibilities

Homeownership comes with responsibilities and costs that Molly should be prepared for.

Property Taxes

- Property taxes are annual assessments levied by local governments to fund public services.

- The amount of property taxes varies depending on the property’s location and assessed value.

- Property taxes are typically paid in installments throughout the year.

Insurance

- Homeowners insurance is required by most lenders to protect against damage or loss to the property.

- Molly should obtain adequate coverage to protect her investment.

- Insurance premiums can vary depending on factors such as the property’s location, age, and value.

Maintenance

- Regular maintenance is essential to preserve the value and functionality of the home.

- Molly should budget for ongoing maintenance expenses, such as repairs, replacements, and upgrades.

- Neglecting maintenance can lead to costly problems in the future.

Market Analysis

Understanding the current housing market conditions in Molly’s area is crucial for making an informed decision.

Market Trends

- Molly should research recent home sales, median prices, and inventory levels in her target area.

- Analyzing market trends can provide insights into the competitiveness of the market and potential risks or opportunities.

- She should consider consulting with a local real estate agent for professional guidance.

Future Outlook

- Molly should consider the potential impact of future market trends on her home value and mortgage affordability.

- Factors such as economic growth, interest rate changes, and population shifts can influence the housing market.

- Staying informed about market forecasts can help Molly make long-term financial decisions.

Clarifying Questions

What are the benefits of making a larger down payment?

A larger down payment can reduce the loan amount, resulting in lower monthly mortgage payments, shorter loan terms, and potentially lower interest rates.

What are some strategies for saving for a down payment?

Create a budget, reduce expenses, explore down payment assistance programs, and consider a side hustle or part-time job.

What are the key factors to consider when choosing a mortgage?

Interest rate, loan term, monthly payments, closing costs, and prepayment penalties are all important factors to evaluate.